RBI MPC Meeting Highlights -December 2025

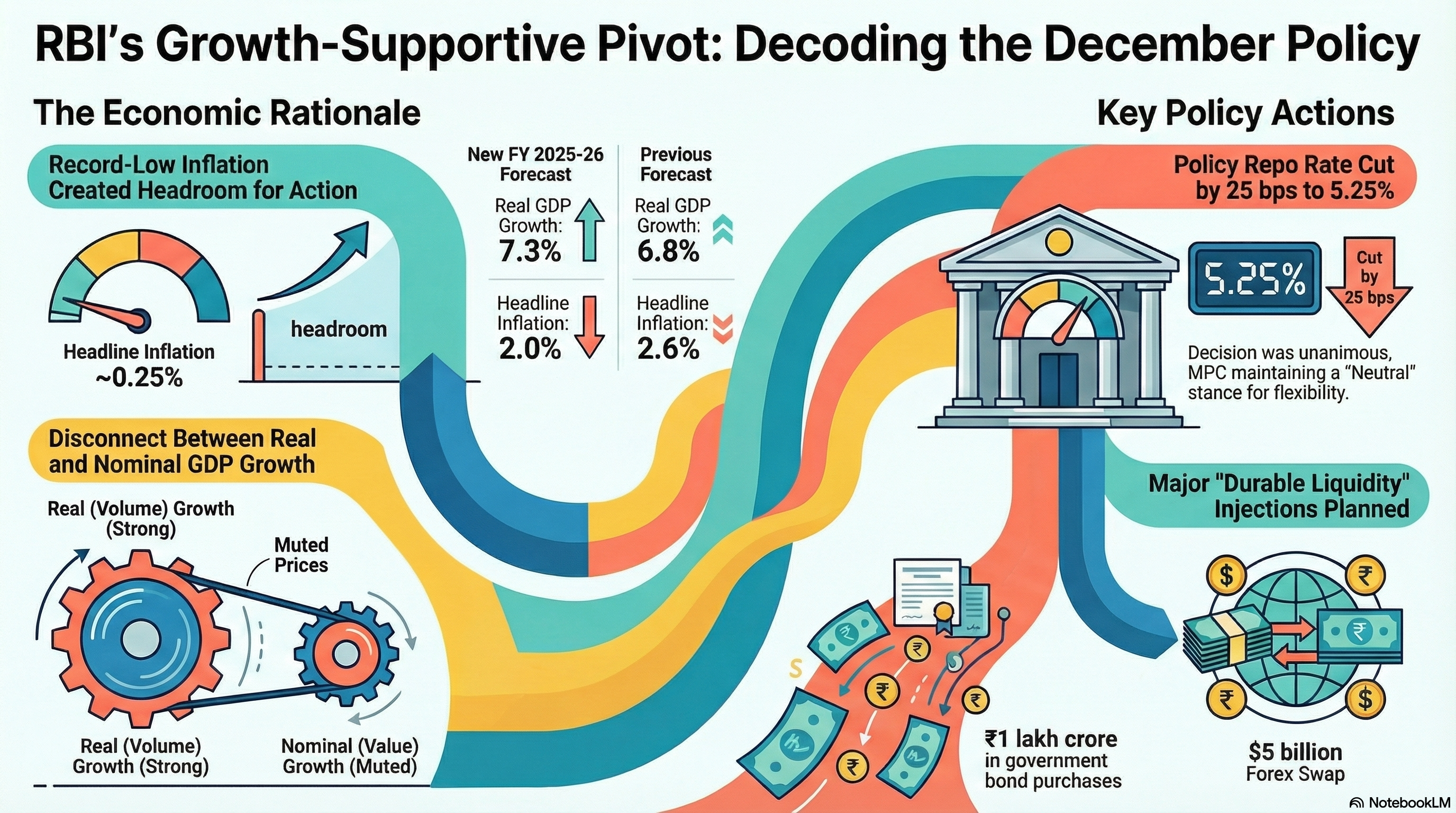

The RBI Monetary Policy Committee delivered a growth-supportive policy, capitalising on a phase of high Real GDP growth and exceptionally low inflation.

Here are the three key highlights :

25 bps rate cut to 5.25% with a Neutral stance, supported by a clearly dovish tone as inflation hits multi-year lows.

Real vs Nominal divergence: Real GDP upgraded to 7.3%, but Nominal GDP remains suppressed due to very low price growth.

Durable liquidity boost: ₹1 lakh crore OMO purchase + $5B FX swap to ease tight liquidity and strengthen transmission

Our take - A Timely Pivot, The economy is delivering strong real GDP (volume) growth, but unusually low inflation is suppressing nominal GDP (value), the real driver of market performance. Since corporate earnings growth fundamentally tied to nominal GDP, high real activity with muted prices doesn’t translate into stronger revenues or profitability. The RBI’s move aims to revive demand, lift inflation back toward the target, and re-energize nominal GDP creating the earnings momentum and value expansion that equity markets need.