At what point does wealth become too complex for a regular wealth manager?

At what point does wealth become too complex for a regular wealth manager?

Turns out, many families have already crossed that line.

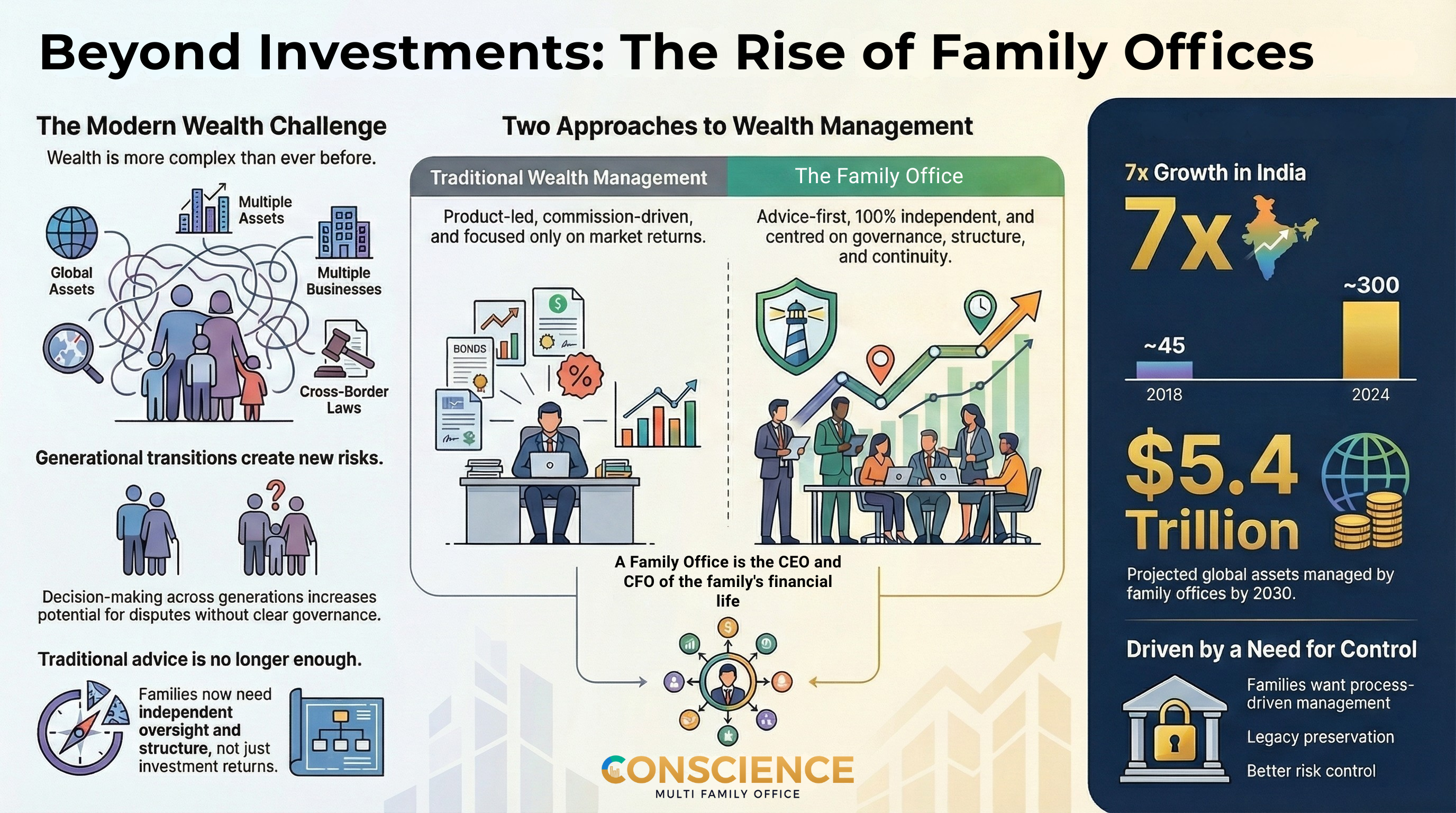

Over the last decade, family offices have become one of the fastest-growing forces in global wealth management. What began as private setups for a few wealthy families has evolved into governance-driven institutions worldwide. Today, 8,000+ family offices manage $3.1 trillion, projected to reach $5.4 trillion by 2030. India mirrors this shift rapidly from 45 family offices in 2018 to nearly 300 in 2024, with AUM expected to grow at 14% CAGR.

This rise is driven by the complexity of modern wealth: multiple businesses, global assets, cross-border rules, succession planning, and increasing liquidity events. Families now need far more than investment advice; they need governance, structure, and an unbiased steward who can oversee their entire financial life.

Family offices enable this shift, moving away from product-driven wealth management toward independent, research-led, long-term stewardship designed to preserve and grow wealth across generations. As India enters a major wealth-creation phase, this model is becoming essential for families seeking continuity, clarity and responsible growth.